- Stepmark Weekly Newsletter

- Posts

- October 3rd Newsletter

October 3rd Newsletter

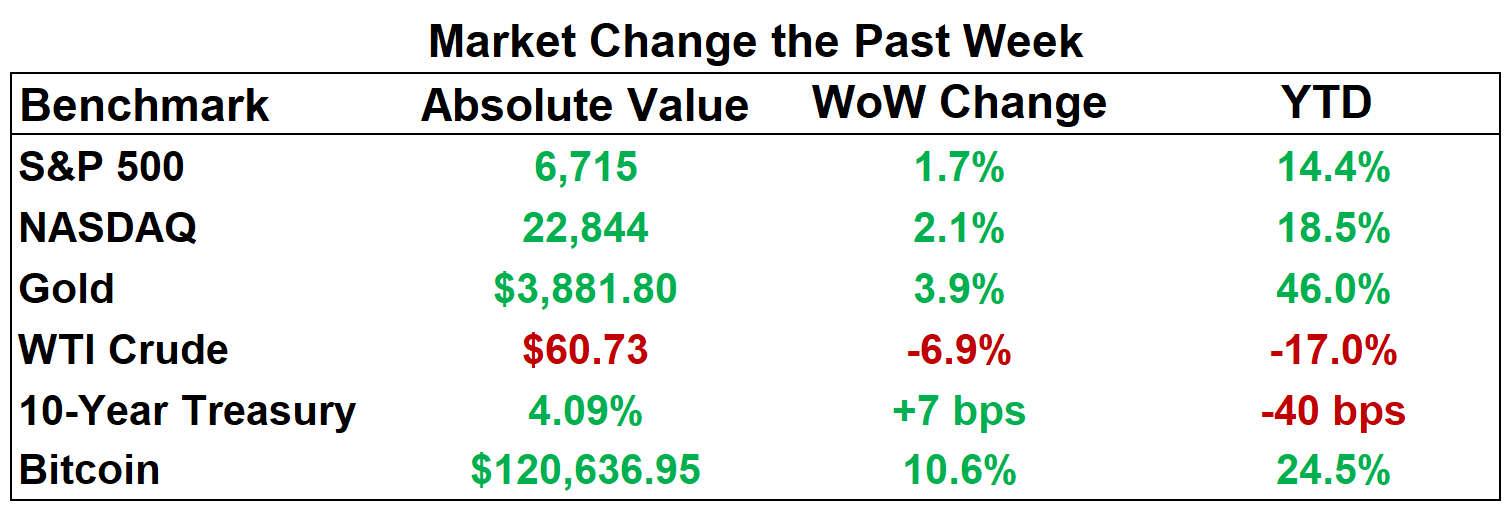

As of close on October 2, 2025

Q2 GDP was revised up to 3.8%, the fastest pace in nearly two years, driven by strong consumer spending and a 7.3% surge in business investment, including a record $40B in data center projects. Despite this momentum, concerns are mounting as consumer confidence dropped to a five-month low, job openings declined, and the US government entered its first shutdown in seven years, halting key data releases and risking a rise in unemployment. Neptune Insurance went public just as the federal flood program froze, offering up to $7M in AI-modeled coverage. In tech and consumer news, Robinhood shares jumped 12% to all-time highs on booming prediction market activity. EA agreed to a record-setting $55B buyout backed by Saudi investment, signaling aggressive expansion in gaming. Meanwhile, Google introduced Gemini for Home, replacing Assistant with smarter, context-aware features across its devices.

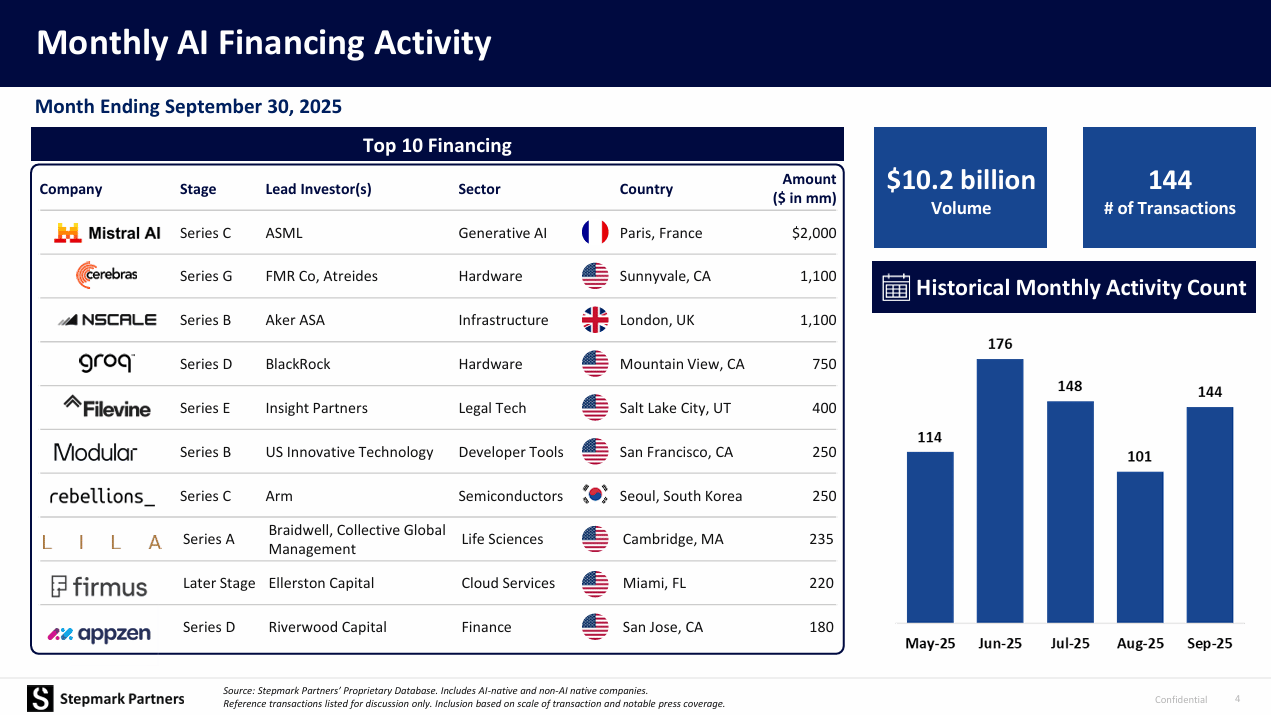

Monthly AI Financing Report: See the September update here.

Top 5 AI Highlights

[1] 📹 OpenAI released Sora 2, a TikTok-style app with realistic physics-based videos, cameos, and parental controls, underscoring the race in AI video platforms. Separately, Meta launched Vibes, an AI video feed in the Meta AI app, letting users create, remix, and share short-form AI videos with music and style edits. Read more from TechCrunch and Meta.

[2] 🎯 Meta will start using AI chatbot conversations to target ads beginning Dec 16. Users can’t opt out, though sensitive topics (religion, politics, health, race, sexuality) are excluded. Meta plans to spend $600B on AI, funded by its $47B Q2 ad business, as rivals OpenAI, X, and Google also explore AI-driven advertising. More from WSJ.

[3] 📉 Accenture cut 11,000+ jobs in an $865M restructuring, warning more exits for staff who can’t be retrained for AI. Revenues hit $69.7B (+7%), net income $7.8M (+6%), with $5.1B AI bookings. Shares fell 2.7% to their lowest since 2020. Read more from FinancialTimes.

[4] 🤖 Anthropic launched Claude Sonnet 4.5, smashing coding records, running 30+ hours, and adding tools like Checkpoints and a VS Code extension. Microsoft unveiled 365 Copilot Agent Mode, turning its AI into a project manager, with Claude 4.5 built into Copilot Studio. More from Anthropic and Microsoft.

[5]🚀 Thinking Machines Lab, cofounded by ex-OpenAI CTO Mira Murati and key ChatGPT researchers, debuts Tinker, an API-driven tool democratizing frontier AI fine-tuning, backed by $2B funding and $12B valuation. Details on Wired.

Founder’s Corner

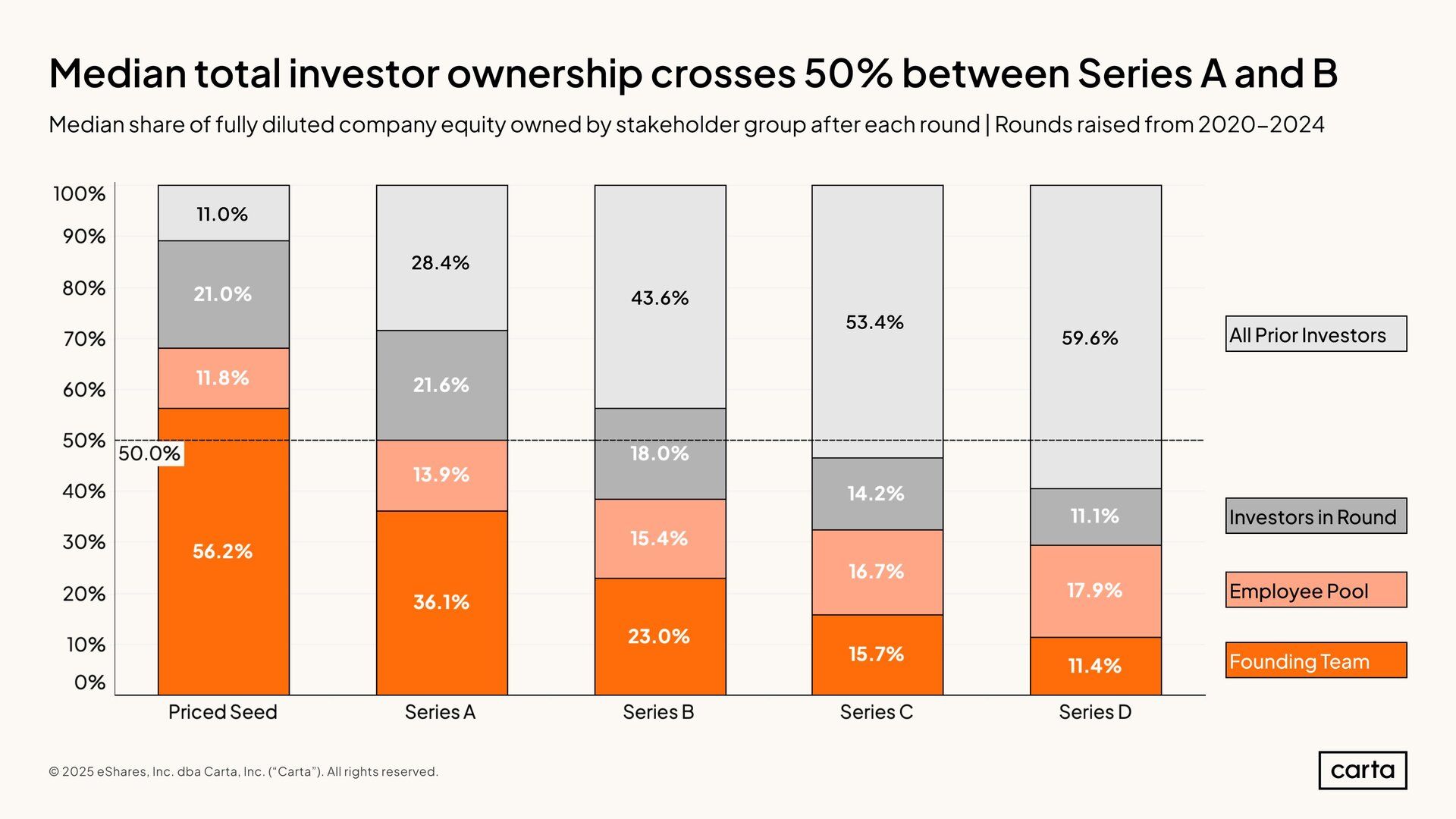

Investor Ownership Crosses 50% between Series A and B

Source: X

What We Read This Week

ADP reported -32K private jobs in September, the only labor snapshot as the BLS shut down with just 1 employee left. Key reports like weekly claims and CPI (Oct 15) may be delayed, though ADP’s data is highly volatile. More from MSN.

Intel shares rose 6.8% on reports it may make chips for AMD, which relies on TSMC. The stock, up ~70% YTD, hit $35.84, aided by its comeback plan and backing from Nvidia and SoftBank. More from MSN.

NYC’s running boom added $934M to the local economy last year, up 58% in 5 years. The NYC Marathon alone generated $692M, including $287M on hotels/dining and $19M on transport. 34 races drew 291k participants and over 1m visitors, while training programs surged 94% YoY with 10k+ runners. More from BBG.

Berkshire Hathaway is nearing a $10B deal for Occidental’s petrochemical unit, which made $5B in sales last year. It would be Buffett’s largest deal since 2022, as Occidental cuts debt and Berkshire deploys $344B cash. More from WSJ.

JPMorgan is being rewired into the first fully AI-powered megabank. Its LLM Suite serves 250k employees, generating decks in 30 seconds and handling complex tasks. Backed by an $18B tech budget, AI could cut 10% of operations staff while boosting margins and reshaping finance. More from CNBC.

Starbucks will close stores and cut 900 non-retail jobs in a $1B restructuring aimed at reversing sales declines. North American stores will shrink ~1% in 2025 after openings and closures. Shares rose 0.1% premarket but remain down 8% YTD. More from Axios.

AI Fundraising news (Sep 26 — Oct 2)

Alex: AI-powered job interview automation startup, raised a $17M Series A

Anything: No-code AI app development startup, raised a $11M Series A

Arqh: AI-powered logistics routing and scheduling, raised a $3.8M Preseed

Assort Health: AI voice agents for healthcare, raised a $76M Series B

Augmented Industries: AI-powered industrial workflow automation, raised a $5.3M Preseed

Axiom Math: AI mathematician research startup, raised a $64M Seed

Bonsai Health: AI-powered healthcare front office automation, raised a $7M Seed

Cerebras Systems: AI chipmaker, raised a $1.1B Series G

Clarifeye: Enterprise AI agent development platform, raised a $4M Seed

Confido Health: AI voice agents for patient communication, raised a $10M Series A

Datawizz: Specialized language model developer, raised a $12.5M Seed

EdSights: AI-powered student retention and engagement platform, raised $80M

Eve: AI assistant for plaintiff lawyers, raised a $103M Series B

Gain: AI agents for procurement and operational workflows, raised a $12M Seed

Gelt: AI-powered continuous tax planning, raised a $13M Series A

InOrbit.AI: AI platform for managing robot fleets, raised a $10M Series A

Lexroom: Legal AI platform, raised a $19M Series A

Manas AI: AI-driven drug discovery startup, raised a $26M Seed extension

Modal Labs: Serverless cloud platform for AI apps and inference, raised a $87M Series B

Neptune Robotics: AI-powered ship hull cleaning robots, raised $52M

Notch.cx: AI-powered customer service automation, raised a $7M Seed

Paid: AI agent monetization and cost tracking platform, raised a $21.6M Seed

Periodic Labs: AI scientist automation startup, raised a $300M Seed

Phaidra: AI agents for managing data centers, raised a $50M Series B

Rebellions: South Korean AI chipmaker, raised a $250M Series C

Rehuman: AI-powered digital wallet for insurers, raised undisclosed

Scorecard: AI agent testing and evaluation platform, raised a $3.75M Seed

Supernova: AI-assisted software design-to-development platform, raised a $9.2M Series A

Valence: Enterprise AI coaching software for employees, raised a $50M Series B

Vercel: Cloud tools for web and AI app development, raised a $300M Series F

Zania: AI-powered security, risk, and compliance automation, raised a $18M Series A