- Stepmark Weekly Newsletter

- Posts

- October 31st Newsletter

October 31st Newsletter

❄️ Now Accepting Intern Applications for Winter 2025!

Stepmark Partners is excited to welcome a new cohort of Fall Analysts beginning on November 17th. If you're passionate about the intersection of AI and deal-making, we invite you to apply. To learn more, please email [email protected].

As of close on October 30, 2025

Markets opened to a major monetary shift as the Federal Reserve cut interest rates by 25 basis points to a range of 3.75% to 4%, the lowest level in three years. The decision followed signs of a weakening job market and a cooler-than-expected inflation report, with the CPI rising 3% in September. As Trump agreed to cut tariffs after meeting Xi in South Korea, China committed to purchasing 25 million metric tons of U.S. soybeans annually, signaling a mutual trade de-escalation. On the tech front, Meta’s Threads app introduced “ghost posts” that vanish after 24 hours, a move aimed at encouraging spontaneous engagement and differentiating from rivals. Their shares fell 12% Thursday morning as 2025 capex guidance rose to $71B, with 2026 expected to be higher. Lastly, 4,300+ U.S. flights were delayed on Thursday due to FAA controller shortages and East Coast storms.

Top 5 AI Highlights

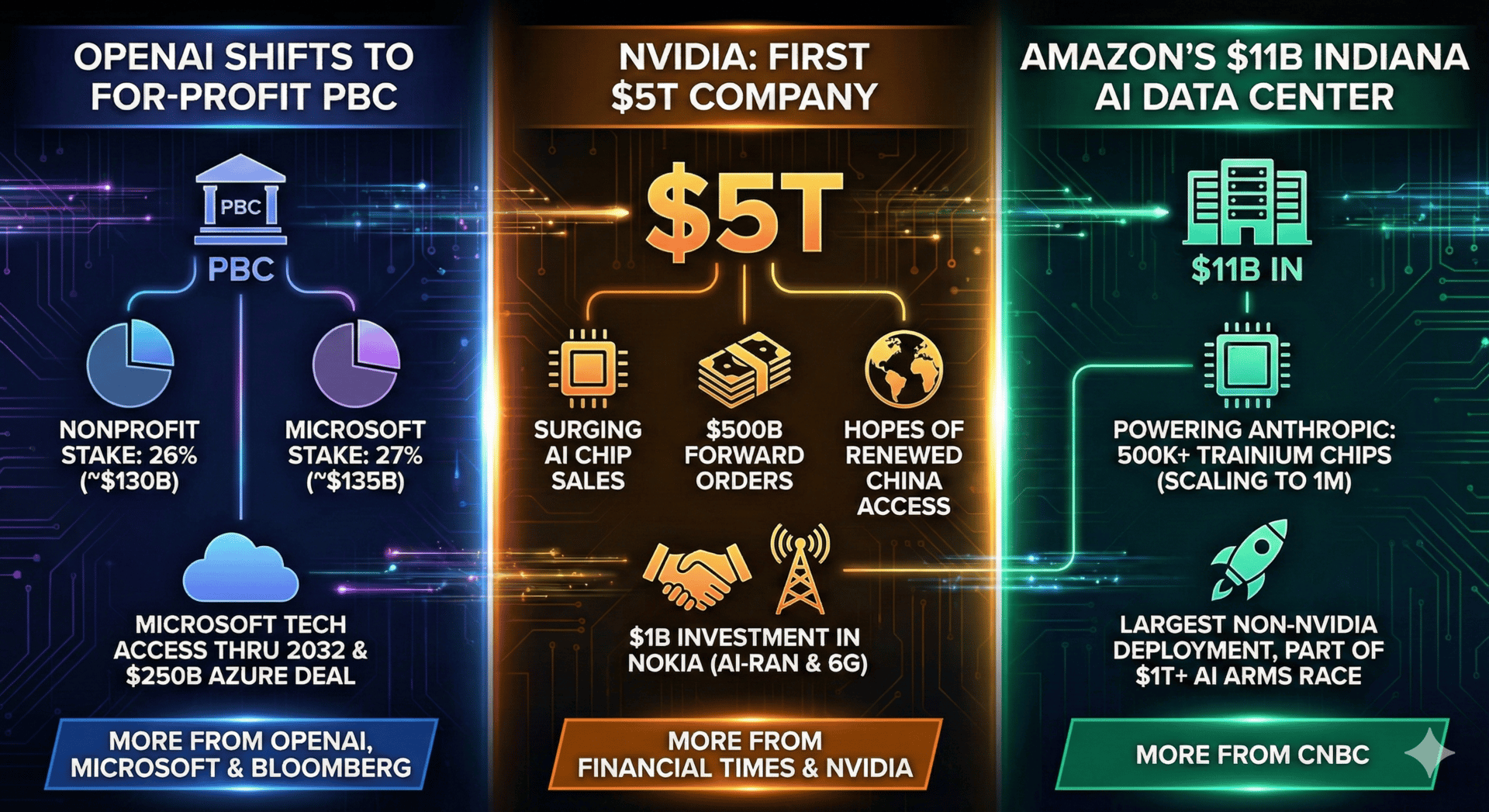

[1] 💼 OpenAI shifts to a for-profit PBC, with its nonprofit holding a 26% stake (~$130B). Microsoft’s stake drops to 27% (~$135B), gaining tech access through 2032 and a $250B Azure deal. More from OpenAI, Microsoft, & Bloomberg.

[2] 🚀 OpenAI is prepping a potential IPO as early as H2 2026, targeting up to a $1T valuation. Backed by $20B revenue, the move follows restructuring and reduced Microsoft dependence (27% stake). More from Reuters.

[3] 🤖 1X’s Neo, a $20,000 humanoid robot, begins preorders for 2026 home use. Currently teleoperated, Neo cleans, folds laundry, and learns via user data, raising privacy and AI autonomy concerns. More from WSJ.

[4] 📈 NVIDIA becomes the world’s first $5T company, driven by surging AI chip sales, $500B in forward orders, and hopes of renewed China access. Also, NVIDIA invested $1B in Nokia to develop AI-RAN and accelerate 6G innovation. T-Mobile, Dell, and Nokia join in pioneering AI-native networks, aiming to reclaim U.S. telecom leadership. More from Financial Times and Nvidia.

[5] 🏗️ Amazon launches a $11B AI data center in Indiana, powering Anthropic with 500K+ Trainium chips—scaling to 1M by year-end. It’s the largest non-NVIDIA deployment, part of a $1T+ AI arms race. More from CNBC.

Founder’s Corner

Why Startups Keep Selling 20%—No Matter What

Source: X

What We Read This Week

OpenAI launches “company knowledge” for ChatGPT, powered by GPT‑5, enabling searches across Slack, Google Drive, SharePoint, and GitHub. The feature turns ChatGPT into a workspace search engine with citations and context. (The Verge)

OpenAI launched a $25B health-focused foundation to fund AI-led advances in diagnostics and treatments, beginning with open health data and grants. It holds equity in OpenAI’s $130B for-profit arm. (X)

Cursor 2.0 debuts Composer, a 4x faster coding model for low-latency agentic tasks, plus a new multi-agent interface enabling parallel workflows, smarter reviews, and automated in-browser testing—streamlining complex coding projects. (Cursor)

Amazon plans to cut up to 30,000 corporate jobs, nearly 10% of its white-collar workforce, citing AI-driven efficiency, overhiring, and bureaucracy reduction. Aims to offset major AI infrastructure investments. (Reuters)

UPS cut 34,000 jobs—well above its 20,000 target—closing 93 facilities and saving $2.2B YTD. Despite a 12.3% volume drop, revenue per package rose, pushing Q3 earnings past expectations. (MSN)

Apollo will sell AOL to Italy’s Bending Spoons for ~$1.5B. With 30M monthly users, AOL offers a strong cash flow. Bending Spoons plans long-term tech upgrades, backed by $4B in debt financing. (Axios)

Ex-L3Harris exec Peter Williams, 39, pled guilty to selling eight U.S. cyber exploits to a Russian broker for millions in crypto, causing $35M losses. Faces up to 20 years in prison. (Cyberscoop)

Q3 Earnings Highlights

Alphabet hit $102.3B in Q3 revenue, up 16%, with Google Cloud soaring 34%. EPS jumped 35% to $2.87. Gemini AI momentum and $155B Cloud backlog highlight growth. (Alphabet).

Amazon shares jump as Q3 revenue rises 13% to $180B; AWS up 20%, its fastest growth since 2022, driven by surging AI demand and plans to expand data center capacity. Net profit rose 39%. (WSJ).

Apple beats Q4 with 3% revenue growth despite iPhone miss; Mac up 6%, services surged 11%. India posted all-time high sales, helping drive record results across emerging markets. (Barrons).

Meta's revenue surged 26% to $51.2B, driven by ad growth. Net income fell 83% due to a $15.9B tax charge. EPS excluding charge was $7.25, up from $6.03. (Meta).

Microsoft posted strong Q1 FY26 results with revenue up 18% to $77.7B, driven by 40% Azure growth. Cloud revenue hit $49.1B, with EPS up 23% non-GAAP. (MSFT).

AI Fundraising news (Oct 24 — Oct 30)

Agtonomy: Software automating farm equipment and autonomous fleets, raised an $18M Series B

Applied Compute: Custom AI agents trained on company knowledge, raised $80M

Arya Health: AI agents automating tasks for post-acute care providers, raised a $18.2M Series A

Ava: AI platform for credit data analysis and loan automation, raised a $15M Seed

Bevel: AI-powered health companion app, raised a $10M Series A

Cartesia: Voice AI using state space models for real-time translation, raised $100M

Chemify: AI and robotics-driven molecular synthesis platform, raised a $50M+ Series B

ConductorOne: Identity cybersecurity for human and AI accounts, raised a $79M Series B

CoreStory: AI platform automating documentation for legacy codebases, raised a $32M Series A

Curve Biosciences: AI-powered diagnostic tests for chronic diseases, raised $40M

Darwin AI: AI compliance and governance platform for government, raised a $15M Series A

Defakto: Enterprise platform securing AI and system interactions, raised a $30.75M Series B

Fireworks AI: AI inference startup for enterprise deployment, raised a $250M Series C

Grasp: AI automation for investment banking and consulting workflows, raised a $7M Series A

Harvey: Legal AI startup for law firms and institutions, raised $150M

Honey Health: AI agents automating healthcare back-office workflows, raised a $7.8M Seed

Impala AI: Infrastructure reducing LLM inference costs for enterprises, raised $11M Seed

Legora: AI platform for legal research and collaboration, raised a $150M Series C

Mem0: AI memory infrastructure platform for developers, raised $24M Seed and Series A

Mercor: AI contractor marketplace for chatbot training, raised a $350M Series C

Moonshot AI: Website optimization platform for enterprises, raised a $10M Seed

Onfire: AI analyzing developer forums for software buying signals, raised a $14M Series A

Ornn AI: Global financial infrastructure powered by AI, raised $5.7M Seed

Polygraf AI: AI security startup mitigating organizational AI risks, raised $9.5M Seed

Seneca: Autonomous firefighting drone developer, raised $60M in Seed and Series A rounds

Simple: AI-powered personalized weight loss app, raised $35M

Socratix AI: AI coworkers for fraud and risk management teams, raised $4.1M Seed

Sublime Security: AI agents protecting against phishing and email threats, raised a $150M Series C

Substrate: U.S. chipmaking challenger to TSMC, raised $100M+

Synthesia: AI video generation platform with virtual presenters, raised $200M

Tensormesh: GPU inference optimization startup, raised a $4.5M Seed

TestSprite: Agentic AI testing tool for software developers, raised $6.7M Seed

Uptiq AI: AI infrastructure for financial institutions, raised $12M

VeroSkills: AI-driven staffing platform for blue-collar employers, raised $5.3M

Vesence: AI document accuracy and consistency checker, raised a $9M Seed

VitVio: AI surgical workflow and coordination automation startup, raised an $8M Seed

Wild Moose: AI platform identifying causes of system failures, raised a $7M Seed