- Stepmark Weekly Newsletter

- Posts

- November 8th Newsletter

November 8th Newsletter

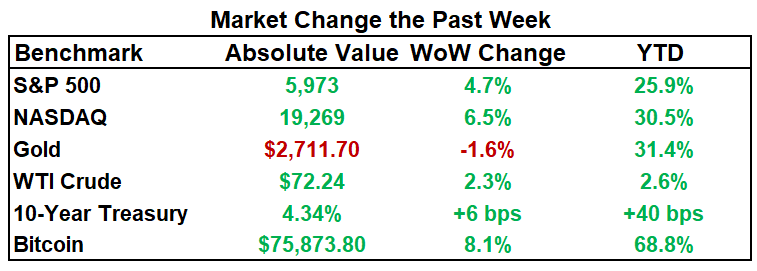

As of the market close on November 7, 2024.

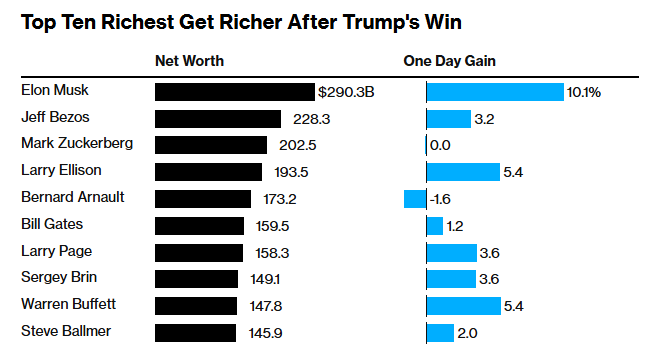

With one of the most debated, well-funded presidential elections, former President Donald Trump has won the U.S. election, becoming the 47th President. US stocks soared on Wednesday after Trump’s clear victory. The Fed made a 25 basis point cut on Thursday and jobless claims rose by 3,000 to 221,000 due to the impact of recent storms. In other news, after nearly two months on strike, around 33,000 Boeing employees accepted a new contract and Novo Nordisk released two new drugs to achieve unprecedented weight loss of up to 25%. And now in November, Mariah Carey has officially kicked off the holiday season, marking the 30th anniversary of the classic "All I Want for Christmas Is You."

Top 5 AI highlights

[1] 🔍Generative AI is increasingly replacing customer service roles, with companies like Klarna and T-Mobile leading adoption. T-Mobile’s $100 million contract with OpenAI aims to develop IntentCX, an AI platform capable of autonomously handling customer interactions. Details here.

[2] ⚡KKR anticipates global data center spending to reach $250 billion annually, with U.S. capacity projected to double or triple in 3-4 years, led by the demand of AI and cloud computing. Recently, KKR secured a $50 billion AI infrastructure deal with Energy Capital Partners and is investing in power generation and transmission infrastructure as well. More information here.

[3] 🎥 Disney has established the Office of Technology Enablement, led by CTO Jamie Voris, to coordinate AI and mixed reality initiatives across its film, television, and theme park divisions. This new unit, set to grow to 100 employees, reflects Disney’s commitment to exploring emerging technologies responsibly. Eddie Drake succeeds Voris as studio CTO. More here.

[4] 🤖 San Francisco-based robotics startup Physical Intelligence raised $400 million at a $2.4 billion valuation, backed by investors like Jeff Bezos and OpenAI. With a team of Tesla and Google DeepMind alumni, the company focuses on integrating general-purpose AI into robotics. Read more here.

[5] 🛡️ Anthropic, Meta, and OpenAI adjust policies to supply AI tools for U.S. military and intelligence, aiming to bolster national defense capabilities amid China’s rapid tech rise. Despite ethical pushback and employee protests, these partnerships reflect Silicon Valley’s increasing role in defense, prioritizing democratic interests in AI development and security. More information here.

Founder’s Corner

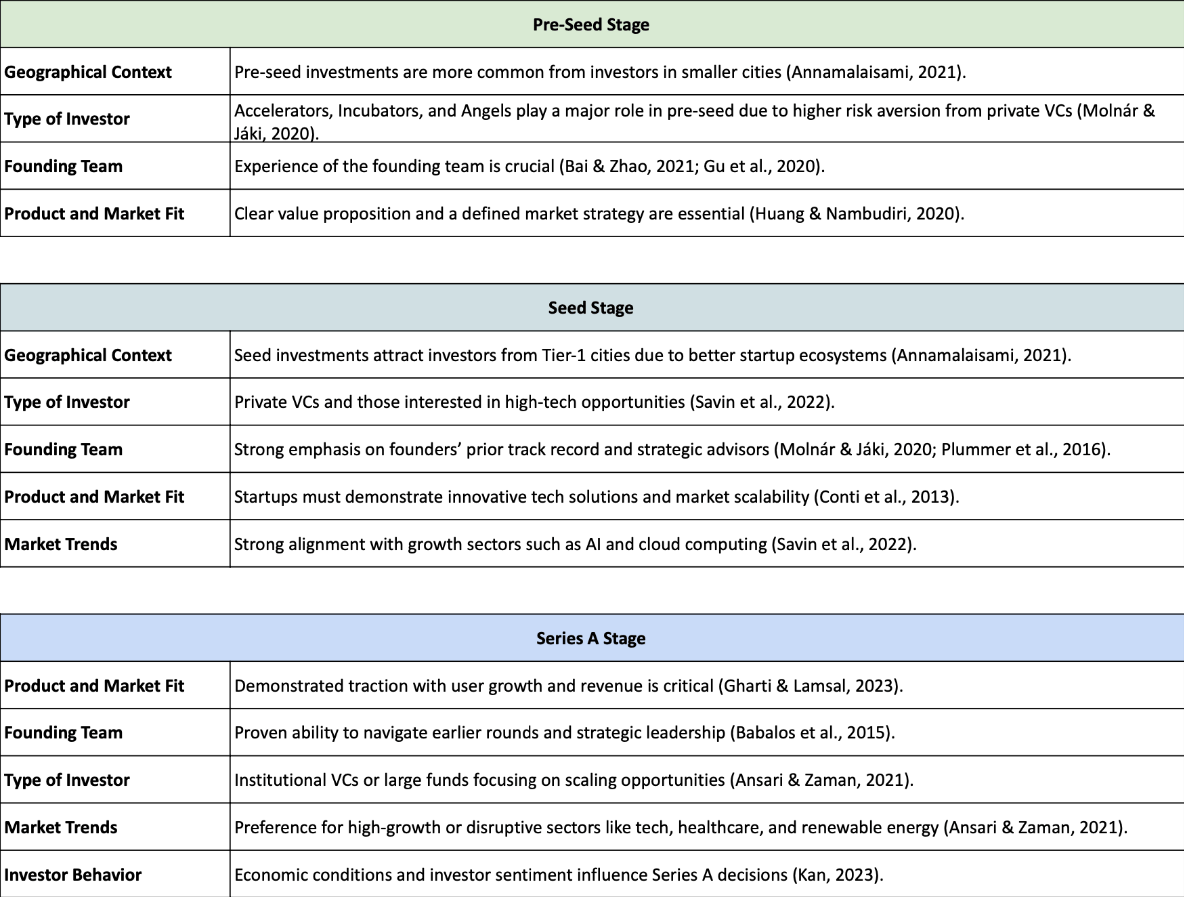

Most impactful determinants for raising your next round

What we read and listened to this week

Massachusetts voters approved allowing Uber and Lyft drivers to unionize, marking a significant labor rights milestone. (Reuters)

Apple faces a potential multibillion-dollar EU fine for App Store practices violating the Digital Markets Act. (The Verge)

Bitcoin surged 70% year-to-date, hitting a record high amid Donald Trump’s 2024 election lead. (CNBC)

Yelp acquires RepairPal for $80M, expanding into auto services and boosting service-focused ad revenue growth. (TC)

Former Meta AR head Caitlin Kalinowski joins OpenAI to lead robotics and consumer hardware efforts. (TC)

CrowdStrike acquires Adaptive Shield, boosting 300% SaaS visibility across 150+ apps (Crowdstrike)

Special Section: Q3 Earnings Highlights

Arm Holdings shares dipped 2.87% as investors took profits despite strong fiscal Q2 results, with revenue of $844 million, +5% YoY, supported by high demand for its Armv9 and CSS platforms. (Barrons)

Cloudflare exceeded Q3 targets, with a revenue increase of 28% YoY to $430.1M. 35% of Fortune 500 are now clients. (BusinessWire)

Palantir jumped 14% after beating Q3 earnings and revenue estimates, forecasting a strong Q4 driven by high AI demand, as net income rose +101% in Q3 YoY. (CNBC)

Qualcomm's Q4 earnings and revenue exceeded expectations with a +9% YoY in revenue, and shares rose 10% soon after the announcement. (CNBC)

Super Micro shares fell 17% after missing revenue estimates and with unaudited results. Q3 sales rose 181% YoY but missed $6.45B expectations. (CNBC)

AI M&A and Fundraising news

November 7:

Corgea: AI-powered security vulnerability detection, raised a $2.5M seed round.

Embed Security: Agentic security platform, raised a $6M funding round.

Regal: AI phone agents, raised a $40M funding round.

Siit: IT service desk solution, raised a $5M Seed round.

Thesys: User interface startup for AI apps, raised a $4M Seed round.

November 6:

eSmart Systems: AI-driven inspection for energy infrastructure, raised $32.5M.

Kardome: Spatial hearing AI tech, raised a $10M Series A round.

Miros: Product image analysis platform, raised a $6.5M pre-Series A round.

November 5:

DeepRoute.ai: Autonomous driving technology, raised a $100M Series C round.

Physical Intelligence: Robotics AI startup, raised $400M at a $2B valuation.

Workgrounds: Corporate hotel booking automation, raised a $2.6M pre-seed round.

November 4:

Algebrik AI: Digital loan origination platform, raised a $4M Series A round.

Ataraxis AI: Breast cancer risk assessment, raised a $4M Seed round.

Cintoo: Reality data management, raised a $42M Series B round.

Plato: AI ERP for wholesalers, raised a $6.5M pre-seed round.

Scalpel AI: Surgical logistics platform, raised a $4.8M round.

November 2:

Noma Security: Security issue detection for AI applications, raised a $32M Series A round.

November 1:

Decart: Israeli 'open-world' AI startup, raised $21M Seed round.

Delos Insurance Solutions: Wildfire risk assessment using AI, raised $9M Series A round.

Endeavor: Enterprise AI for manufacturing, raised $7M Seed round.

Herald: Digital infrastructure for commercial insurance, raised a $12M Series A round.

MOTORMIA: AI-powered automotive platform, raised a $8M round.

Swoove Studios: 3D animation platform, raised a $7.5M Seed round.

Troveo: Content licensing for AI training, raised a $4.5M Seed round.

Attached to this email, you’ll find a summary of this week’s highlights and the financial performance of select public companies, providing you with a snapshot of recent market movements.

|