- Stepmark Weekly Newsletter

- Posts

- May 16th Newsletter

May 16th Newsletter

Recent Deal Announcement

Stepmark Partners is pleased to announce that we served as financial advisor to Truework in its sale to Checkr; transaction terms were not disclosed.

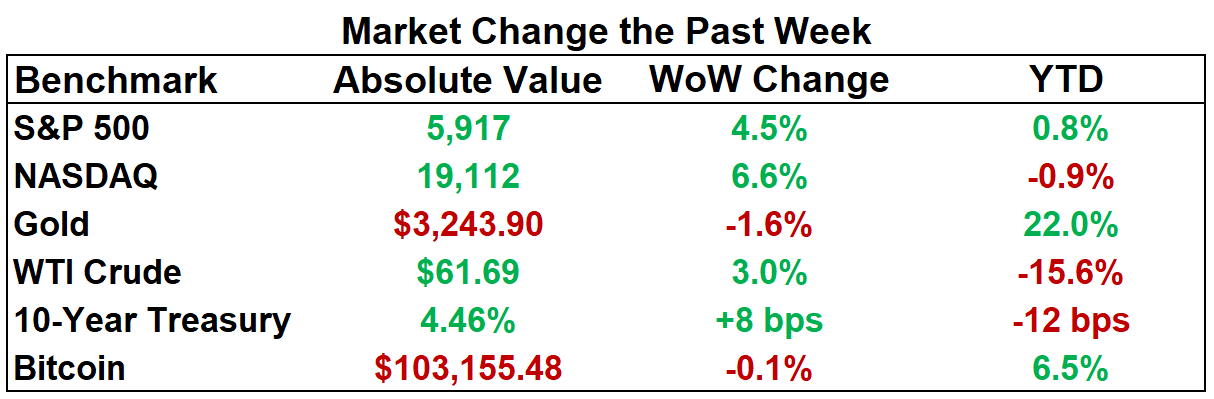

As of close on May 15, 2025

U.S. inflation held at 2.3 percent in April, the lowest since February 2021, yet analysts warn that trade tensions and tight inventories could lift prices by summer, making the Fed’s decision on interest rates tougher. President Trump said China will open its markets and pause some tariffs with the US for 90 days. Many CEOs are rushing shipments while the window is open. President Trump’s recent Middle East trip also drove a wave of U.S.-linked deals: Saudi Arabia pledged $600 billion for projects in America; Nvidia will ship 18,000 advanced chips to Humain, a new Saudi AI startup; AWS plans a $5 billion “AI Zone”; Google, in partnership with Saudi VC firm STV, is backing a new $100 million AI fund and Boeing and GE Aerospace landed a $96 billion Qatar Airways order for up to 210 jets, a contract expected to support about 1 million U.S. jobs throughout production and delivery. On Wall Street, digital bank Chime filed for its long-awaited IPO, and social-trading firm eToro soared 40 percent in its Nasdaq debut on Wednesday. Elsewhere, Microsoft will cut 3 % of staff to focus on AI. UnitedHealth chair Stephen Hemsley has stepped back in as CEO after a sudden leadership shake-up amidst share volatility.

Top 5 AI Highlights

[1] 💡 Perplexity AI is in late-stage talks to raise $500 million at a $14 billion valuation, down from its $18 billion target in March. This adjustment reflects growing investor caution amid intensifying competition from OpenAI, Anthropic, and Google. Generating nearly $100 million ARR, Perplexity is also exploring Safari integrations with Apple alongside OpenAI and Anthropic—an opportunity to recapture search volume lost to AI tools. If successful, this tie-up could diversify Perplexity’s revenue streams and bolster its positioning ahead of the AI browser “Comet” launch. More from CNBC

[2] 🔄 OpenAI and Microsoft are renegotiating their partnership as OpenAI eyes a future IPO and secures Microsoft’s priority tech access. The company has scrapped its plan to become a full for-profit public-benefit corporation—now only its for-profit arm will adopt that status under nonprofit oversight. This tweak unlocks $30 billion in SoftBank funding (potentially $20 billion if not completed by year-end), a structure SoftBank CFO Yoshimitsu Goto says focuses on for-profit growth. Meanwhile, the $500 billion “Stargate” data-center project faces 5–15% cost overruns from tariffs and rising expenses, underscoring the challenge of scaling AI infrastructure. Details on FT, WP and TC.

[3] 🚀 CoreWeave reported standout Q1 revenue of $981.6 million, up 420% YoY growth and roughly $100 million more than analyst estimates, while projecting full-year sales of $4.9 billion to $5.1 billion. After an initial 11% rally, the stock closed down 5.4% as investors weighed management’s plan to invest $20 billion to $23 billion in AI infrastructure and expanded data-center capacity. In related news, The Information noted that an AI-focused data center in North Dakota is still struggling to secure customers. Meanwhile, CoreWeave reportedly held a JPMorgan-led roadshow last week to raise $1.5 billion in debt financing after securing only $1.5 billion of the previously expected $2.7 billion from its IPO. Details on YF, FT, and TI.

[4] ⚖️ Anthropic, represented by its lawyer in a California copyright lawsuit with Universal Music Group and other publishers, admitted that its Claude AI chatbot generated faulty citations. This is the latest instance of lawyers using AI in court and then regretting the decision. Earlier this week, a California judge slammed a pair of law firms for submitting “bogus AI-generated research” in his court. In January, an Australian lawyer was caught using ChatGPT in the preparation of court documents, and the chatbot produced faulty citations. These incidents highlight a broader challenge for AI developers, balancing rapid deployment with reliable outputs as the technology scales across sensitive sectors. Details on TC.

[5] 🎥 MasterClass is beta testing “OnCall”, a new feature that lets subscribers dialogue with AI-cloned experts such as Gordon Ramsay and Mark Cuban. Currently separate from core memberships, OnCall offers free-form conversations, suggested prompts, and a general roleplay generator for practicing tough discussions. By leveraging its existing video library to train these avatars, MasterClass aims to deepen engagement, boost retention, and unlock premium upsells—a strategic bet on personalized, interactive learning in a crowded online-education market. Watch the demo on X.

Founder’s Corner

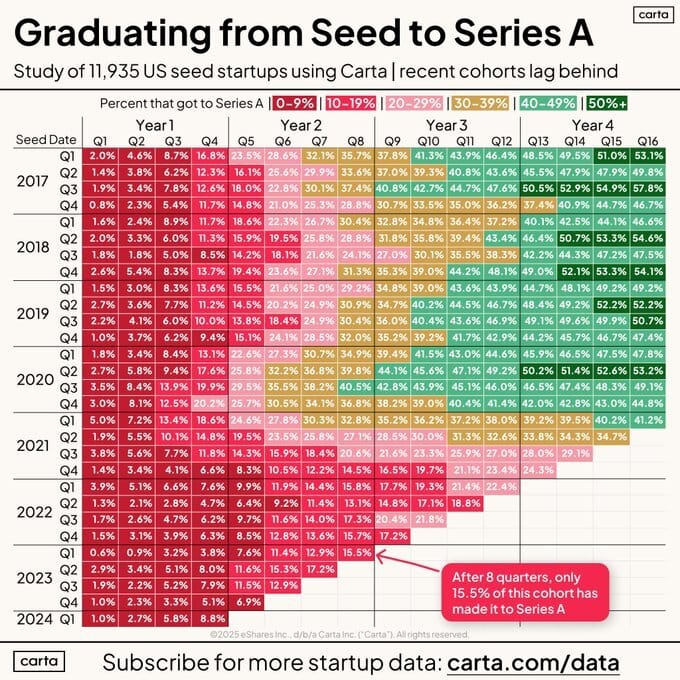

Since 2022, reaching Series A from Seed has become more difficult

Source: X

What We Read This Week

Chegg will lay off 22% of its workforce, close U.S. and Canada offices, and cut costs as AI competition pressures revenue, which fell 30% in the first quarter. (CNBC)

General Motors has appointed former Tesla executive and Aurora co-founder Sterling Anderson as its chief product officer, overseeing all vehicle lifecycles as it pushes forward with electric and gas models. (CNBC)

President Donald Trump has revived a controversial "most favored nation" policy to cut U.S. drug costs by tying prices to lower rates abroad, despite industry pushback and potential legal challenges. (CNBC)

A new FTC rule requiring hotels and short-term rentals to disclose "resort fees" takes effect, aiming to boost transparency despite concerns over weakened enforcement under the Trump administration. (CNBC)

Celebrating 10 years of its Archways to Opportunity program, McDonald's plans to hire up to 375,000 U.S. workers this summer, expanding its footprint with 900 new restaurants by 2027. (McD)

Dick’s Sporting Goods is buying Foot Locker for $2.4 billion, adding $8 billion in revenue but facing strategic risks and regulatory scrutiny. (BBG)

AI M&A and Fundraising news (May 9 — May 15)

Akido Labs: AI assistants for doctors to improve treatment efficiency, raised $60M Series B

Carta Healthcare: AI-powered software for automating clinical data abstraction, raised $18.25M.

Celery: AI-powered finance expense review and validation tools, raised $6.3M Seed.

Cohere Health: AI-powered prior authorization technology, raised a $90M Series C.

CoreWeave: AI cloud computing firm, in talks to raise $1.5B debt due to lower raise in IPO.

CueZen: AI and health data platform for patient habit improvement, raised $5M.

Egune AI: Foundational AI platform for Mongolian language and culture, raised $3.5M.

Glass Imaging: AI-powered digital image enhancement software, raised $20M Series A.

Granola: AI-powered note-taking app, raised $43M Series B.

Haast: AI for regulatory compliance in marketing workflows, raised $6M Seed.

Harvey: AI-powered legal assistants for law firms, in the market to raise $250M.

Hedra: AI-powered video generation and editing suite, raised $32M Series A

Kickscale: AI-powered sales conversation analysis for B2B teams, raised $2.3M Seed.

Layer: AI-powered app gateway for game developers, raised a $6.5M Seed.

MarvelX: AI-powered claims automation and fraud detection for insurers, raised $6M Seed.

Medmain: AI-powered digital pathology analysis platform, raised $3.3M.

Mentaily: AI-powered diagnostic tools for mental health, raised $3M Seed.

Operand: AI for automating strategic analysis and business advice, raised $3.1M.

Optimal Dynamics: AI-powered freight planning automation, raised $40M Series C.

Owner.com: AI website building, marketing, and automation tools for restaurants, raised $120M.

Pathos AI: AI for developing oncology drugs, raised $365M Series D

Pony AI: Autonomous driving company, filed for a Hong Kong IPO, after raising ~$413M in a US IPO in November 2024.

Perplexity AI: AI-powered conversational search platform, closing in on $500M.

Posha: AI-powered home booking assistant, raised $8M.

Samaya AI: AI models that assist financial analysts, raised $43.5M Series A

StackOne: Tech to integrate SaaS and AI agents with enterprise systems, raised $20M Series A

Stash: AI-powered financial advice and savings tools, raised $146M Series H.

TensorStax: AI agents for automating data engineering tasks, raised $5M.

Theom: AI data security for cloud environments, raised $20M.

Usul: AI-powered contract discovery for defense contractors, raised $3.3M Seed.

WisdomAI: Tools to reduce hallucinations in LLMs, raised $23M Seed.

Zapia: AI-powered WhatsApp assistant for task management, raised $7.25M Seed.