- Stepmark Weekly Newsletter

- Posts

- July 25th Newsletter

July 25th Newsletter

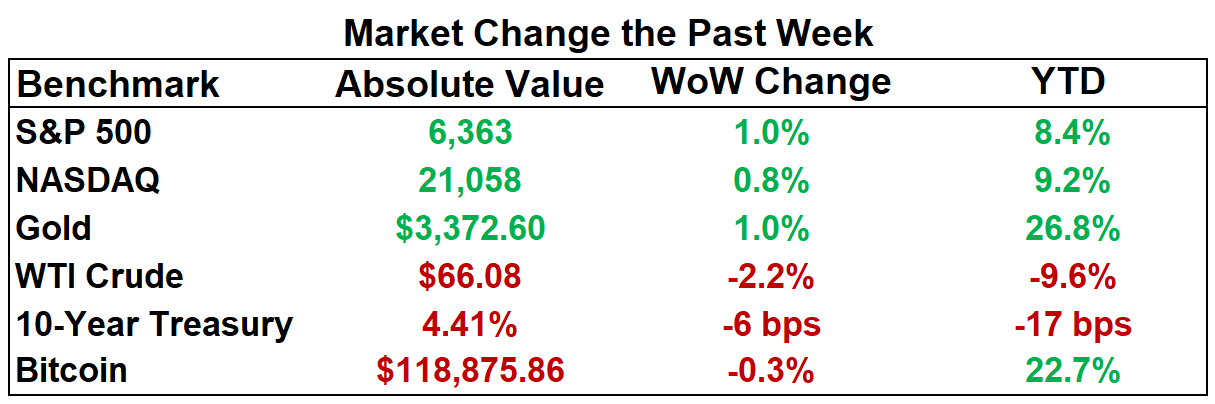

As of close on July 24, 2025

Tariff tensions return as Treasury Secretary Bessent calls for a full investigation into the Fed’s inflation response, intensifying Trump-era pressure on Chair Powell. Stellantis posted a $2.7B loss, hit by €300M in tariffs and restructuring, while AstraZeneca announced a $50B U.S. investment tied to potential 200% drug tariffs. Consumer sentiment rose to a five-month high in July as inflation fears eased, though expectations remain above pre-tariff levels. In tech, chip stocks jumped on AI optimism, but markets are overlooking risks from revived Trump-era tariffs on chips and electronics. Block shares rose 10% on news that it will join the S&P 500 on July 23, replacing Hess after the Chevron deal and boosting tech’s index weight. On the consumer side, NYC and NJ project a $3.3B boost from hosting the 2026 World Cup, with over 1.2 million visitors and 26,000 jobs expected.

Top 5 AI Highlights

[1] 📜Unveiled on Wednesday, President Trump’s “Winning the Race: America’s AI Action Plan” lays out 90 federal actions to secure global dominance through three pillars: (1) supercharging private-sector innovation, (2) scaling energy and semiconductor infrastructure, and (3) spearheading international standards, while integrating deregulation, workforce upskilling, grid upgrades, secure data centers, and forceful export-control enforcement to outpace China’s ascent. More on AI.gov and the All-In Podcast

[2] 🐝Amazon has acquired Bee, a $49.99 wearable that uses always-on microphones and AI to transcribe, summarize, and contextualize your daily life. All employees join Amazon; terms undisclosed. Amazon promises stronger privacy and no sale of customer information. More from The Verge.

[3] ⚡OpenAI has partnered with Oracle to build 4.5 gigawatts of new U.S. data center capacity, powering Stargate—OpenAI’s AGI infrastructure play. This will bring Stargate’s total to over 5 GW, running 2M+ chips, and signals acceleration beyond the original $500B commitment announced at the White House. More from OpenAI.

[4] 🚀Elon Musk’s xAI, fresh from a recent $10B equity-debt raise, is now working with Valor Equity to secure up to $12B more funding for Nvidia chips and a new supercomputing data center to train Grok. To fund the push, xAI pledged Grok’s IP as collateral and leaned on SpaceX to inject $2B. More from MSN.

[5] 🥇OpenAI and Google DeepMind stunned the AI research community by earning gold at the 2025 International Math Olympiad—each scoring 35 of 42 possible points—an unprecedented leap from GSM8K-to-AIME benchmarks and a striking proof that a general-purpose language model can craft multi-page proofs. Read more from X and X.

Founder’s Corner

Our friends at Founder’s Box, an early-stage AI accelerator, is offering $150K in SAFE funding plus coaching on storytelling, investor pitches, and go-to-market plans. Applications for the Fall 2025 cohort close August 8. Learn more at thefounderbox.com

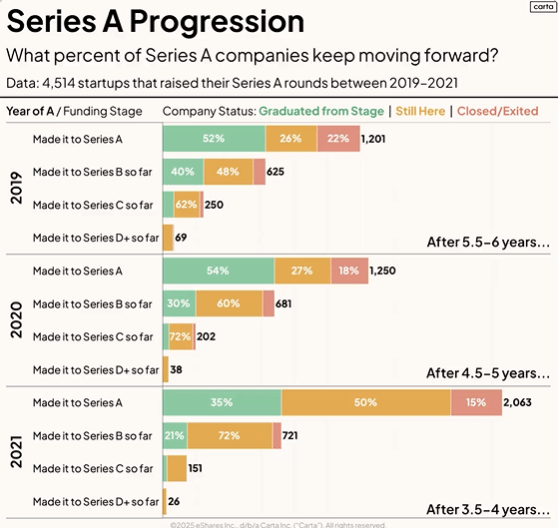

Only ~50% or so of Series A companies end up raising Series B

Source: X

What We Read This Week

Walmart hires Instacart’s Daniel Danker to spearhead global AI strategy, reporting directly to CEO Doug McMillon—highlighting AI's rising strategic role in retail transformation and operational efficiency. (WSJ)

Ambiq Micro, backed by Arm, plans to raise up to $85 million in a U.S. IPO, offering 3.4 million shares at $22–$25, targeting a $491 million fully diluted valuation. (BBG)

Peter Thiel-backed crypto exchange Bullish filed for NYSE IPO under “BLSH,” citing $1.25 trillion in total trading volume and aiming to boost adoption of stablecoins and blockchain tech. (CNBC)

Billionaire Patrick Soon-Shiong plans to take the Los Angeles Times public within a year, aiming to "democratize" ownership and restore public trust in journalism, he said on The Daily Show. (BBG)

Apple’s first foldable iPhone will launch in late 2026, mirroring Samsung’s book-style design and components, but with hinge and display refinements, marking a rare late, non-revolutionary market entry for Apple. (BBG)

Secondary deal volume hit a record $102B in H1 2025, outpacing most full-year totals. Continuation funds raised $25B, signaling robust demand and liquidity in private equity markets. (Pionline)

Q2 Earnings Highlights

Alphabet beat Q2 expectations with EPS of $2.31 and revenue of $96.4B, driven by 32% Google Cloud growth and strong ad sales. CapEx surged to $85B, raising investor concerns despite solid margins. (Barron’s)

Tesla missed earnings and revenue expectations, with sales down 12% YoY. Shares fell 9% on Thursday. Affordable model production begins in 2025. Regulatory credit revenue halved with U.S. sales pressured by tax credit expiry. (YF)

Intel beat Q2 revenue estimates but posted a wider loss amid ongoing turnaround efforts. Most of its planned 15% workforce reduction is complete; shares slide amidst cost-cutting measures. (YF)

GM Q2 profit drops 35% YoY as tariffs slash $1.1B; shares fall 7%. Deeper Q3 impact expected, but 2025 guidance held. EV sales surge; U.S. production to rise by 300K units by 2027. (WSJ)

Capital One beats Q2 profit estimates with $5.48/share adjusted earnings and $10B net interest income, despite a $4.3B net loss tied to the Discover deal. Integration underway; shares up slightly post-earnings. (BBG)

AI M&A and Fundraising news (July 18 — July 24)

Alix: AI-driven estate settlement platform, raised $29.63M

Ashby: AI-powered talent platform for hiring teams, raised a $50M Series D

Augmodo: AI-powered retail inventory badge system, raised $37.5M

BrightAI: AI for industrial power system monitoring, raised a $51M Series A

Composio: AI infrastructure for agent learning, raised a $29M Series A

Confident Security: Encrypted AI infrastructure provider, raised a $4.2M Seed

Cover Whale: Commercial auto insurtech for trucking, raised a $40M Series B

Coverflow: AI tools for insurance claims/fraud detection, raised a $4.8M Seed

Data Phleet: AI-powered compliance automation for utilities, raised a $0.60M Pre-Seed

DebitMyData: Ethical AI for identity verification and monetization, raised a Seed

Delve: Automates regulatory compliance with AI, raised a $32M Series A

Diode Computers: AI-powered PCB design/manufacturing platform, raised $14.49M

Elysian Insurance Services: AI-native commercial insurance TPA, raised $6M

Empirical Security: AI to detect/block software vulnerabilities, raised a $12M Seed

EvenBetter: AI-powered software for workplace equity, raised $0.31M

GeologicAI: AI rock/core data capture tech, raised a $44M Series B

GigaIO: Connects data center components for AI, raised a $21M Series B

Greptile: AI to automate code review, raised a $30M Series A

Gupshup: Business messaging unicorn from India, raised $60M

Hyper: AI voice automation for 9-1-1 call centers, raised a $6.3M Seed

Hypernatural: Generative AI video creation platform, raised a $6.8M Seed

iCounter: AI platform to combat cyber risks, raised a $30M Series A

Kiku: AI for frontline job applicant interviews, raised a $4.6M Seed

Nexxa.ai: AI-native agents for heavy-industry engineering, raised a Pre-Seed

One Biosciences: AI-driven cancer therapy developer, raised a $17.4M Series A

Perplexity: AI-powered search and browser platform, raised at $18B valuation

Poseidon AI: Decentralized AI training data platform, raised a $15M Seed

Propel People: AI hiring platform for skilled trades, raised a $3M Seed

Quandri: AI tools to automate insurance back-office, raised $12M

Q.ANT: Energy-efficient photonic processors for AI, raised a €62M Series A

Reka AI: Efficient LLM development startup, raised $110M

Solomon AI: Tax automation AI agent for firms, raised $6.8M

StrongestLayer: Email cybersecurity via AI threat detection, raised a $5.2M Seed

Testaify: AI-powered QA test automation platform, raised $2.61M

Vaudit: AI auditing platform for ad fraud detection, raised a $7.3M Seed

Vultron: AI tools for federal contractors, raised $22M

Xelix: AI AP automation connecting ERP systems, raised a $160M Series B