- Stepmark Weekly Newsletter

- Posts

- January 9th Newsletter

January 9th Newsletter

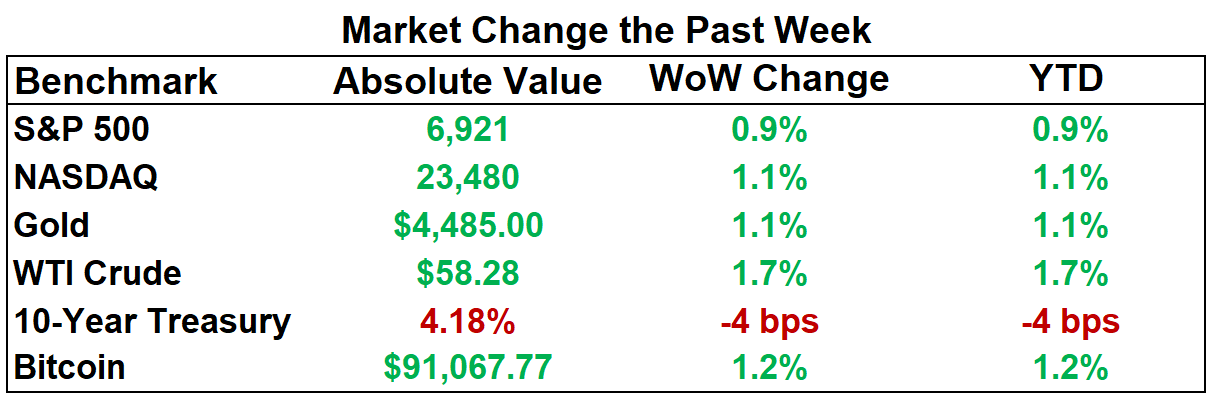

As of close on January 8, 2026, WoW and YTD Calculations used data from January 2, 2026

Markets opened 2026 on uncertain footing: U.S. nonfarm payrolls rose just 50,000 in December vs. 73,000 expected, while the unemployment rate dipped to 4.4%. According to ADP, U.S. private payrolls rose just 41,000 in December versus 115,000 expected, while wage growth held steady at 4.4%. Even with mortgage rates easing to 6.25%, housing demand softened over the holidays—applications fell 9.7%, with refinancing down 14% and purchase activity off 6%. Dealmakers didn’t take time off: JPMorgan is set to acquire Apple’s ~$20B Card program from Goldman at a reported $1B+ discount. In mega-cap and media, Alphabet briefly claimed its first lead vs. Apple since 2019, with a $3.88T market cap (vs. Apple’s $3.84T), and Warner Bros. rejected Paramount’s $108B hostile bid, opting instead for Netflix’s $83B mostly-cash offer amid concerns over debt and regulatory risk. Meanwhile, enterprise software M&A is already leaning into the AI stack—CrowdStrike is buying identity-security startup SGNL for $740M, and Snowflake plans to acquire observability platform Observe for about $1B. Catch the latest from CES 2026 on CNET:

Source: U.S. Bureau of Labor Statistics via FRED

Chart from CNBC

Our 2025 Year in Review is now live on our website. Check it out here.

Top 5 AI Highlights

[1] 🩺 OpenAI launched ChatGPT Health to limited users, integrating with health apps to assist users in interpreting tests, managing care, and wellness planning. Over 40 million people use ChatGPT daily for health info—70% after hours—highlighting AI’s expanding role and prompting scrutiny over mental health guidance. More from Bloomberg and Axios.

[2] 🚀 Nvidia unveiled its Vera Rubin platform at CES 2026, delivering 5x faster inference, 8x efficiency gains, and powering key AI systems from OpenAI to AWS, amid a $4T infrastructure boom. More from Nvidia.

[3] 💰 Anthropic signs $10B funding term sheet at $350B valuation, led by Coatue and GIC. Backed by Amazon, Microsoft, and Nvidia, it rivals OpenAI ($500B). Claude 4.5 models mark its latest AI push. (CNBC)

[4] 💰 xAI raised $20B in an oversubscribed Series E round led by top investors including Nvidia and Fidelity, fueling Grok 5 development, Colossus GPU expansion, and products for 600M+ users. Details from xAI.

[5] 🤝 Nvidia is acquiring Groq’s AI chip assets for $20B in its largest deal to date, gaining proprietary low-latency inference tech. Groq leadership will join Nvidia, while GroqCloud remains an independent entity amid surging demand for AI infrastructure. Separately, OpenAI acqui‑hires Convogo’s three co‑founders in an all‑stock deal to accelerate AI cloud initiatives; Convogo’s executive coaching product will wind down. More on Nvidia and OpenAI.

✨Open Source AI Development

[1] 📈 Chinese AI IPO momentum built in Hong Kong: MiniMax raised ~$619M at the top of its range, with institutions 70x+ oversubscribed (Bloomberg), while Z.ai (Zhipu AI) jumped 13.2% on debut after a ~$558M IPO at ~$6.55B valuation (Reuters).

[2] 👁️ Nvidia launched Alpamayo, an open-source portfolio of AI models, simulations, and datasets for Level 4 autonomous vehicles. It emphasizes reasoning-based autonomy, transparency, and regulatory-ready tools for faster, safer AV development. More on Nvidia.

[3] 💹 China’s Moonshot AI raised $500M in a Series C round led by IDG, reaching a $4.3B valuation. Flush with $1.4B cash, it’s delaying IPO plans despite global growth. More from SCMP.

[4] 💻 Nous Research released open-source NousCoder-14B, matching closed-source coding models with 67.9% LiveCodeBench accuracy. The model was post-trained in four days with reinforcement learning on top of Qwen 3-14B, highlighting open-source AI’s rapid progress. Info on VentureBeat.

[5] 🦊 Mozilla announced advancing open-source AI as one of its core goals, aiming to make open AI easier to use than closed systems, reshape data economics, and prevent intelligence from becoming a rented, centralized utility. Details on Mozilla's Blog.

Founder’s Corner

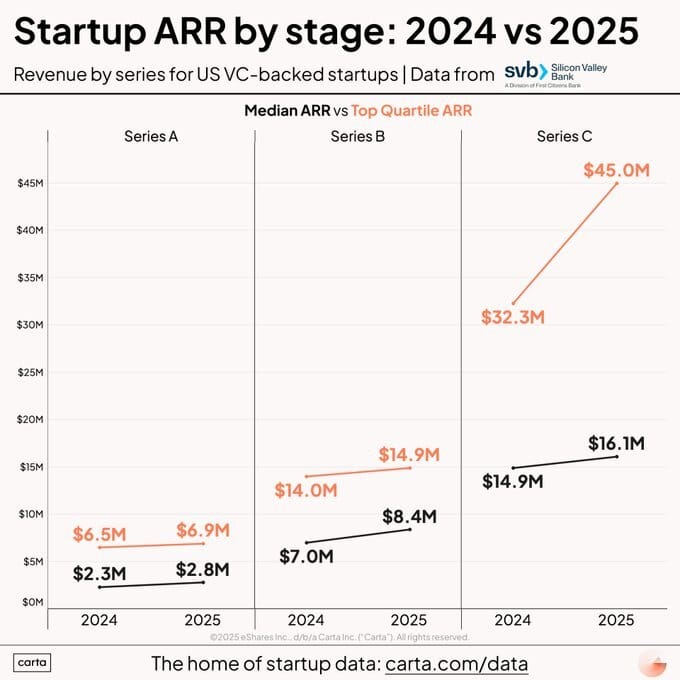

Startup ARR by stage for 2024 and 2025

Source: X

What We Read This Week

Yann LeCun criticized Meta’s $14B hire Alexandr Wang as “inexperienced,” predicting staff exits and denouncing LLMs as a dead end, while launching his own startup focused on next-gen AI approaches. (FT)

Meta acquired Singapore‑based AI agent startup Manus in late December 2025 for over $2 billion, gaining autonomous task‑executing agents to enhance Meta AI and its consumer products; the deal now faces a Chinese regulatory review. (CNBC)

Cisco is in advanced talks to acquire Israeli cybersecurity firm Axonius for $2B, below its $2.6B valuation. Axonius raised ~$700M, offers device visibility, and recently acquired Cynerio for healthcare security. (Ctech)

Palo Alto Networks is in talks to acquire Israeli cybersecurity startup Koi for $400M. Founded in 2024, Koi raised $48M and protects 500K+ endpoints via AI-powered software supply chain security. (Ctech)

Waymo (US) and Baidu (China) are set to launch competing driverless taxi services in London, marking the first city to host both. The UK’s green light for commercial trials has positioned it as a key international battleground for AV expansion. Waymo is nearing 1M weekly rides in the US, while Baidu’s Apollo Go reached 17M cumulative rides in November 2025. (FT)

Discord has confidentially filed for an IPO, targeting a March debut with Goldman Sachs and JPMorgan as underwriters. Last valued at $14.7B, the platform now boasts 200M+ monthly users. (TechCrunch)

Strava confidentially filed for an IPO with Goldman Sachs, aiming for a spring debut. Profitable with 50% revenue growth, it seeks investor interest at a prior $2.2B valuation. (The Information)

Google is integrating AI into Gmail, offering tools like 'Help Me Write,' email summaries, and AI-powered search for paid subscribers. Features aim to boost productivity but raise privacy and accuracy concerns. (CBS)

Baidu’s AI chip unit Kunlunxin hired CICC, Citic, and Huatai for a Hong Kong IPO, targeting up to $2 billion, highlighting strong investor demand for China’s strategic AI semiconductor sector. (Bloomberg)

AI Fundraising News (Dec 19 — Jan 9)

AgileRL: Reinforcement learning platform for AI model training, raised $7.5M

Articul8: Enterprise AI startup, raised a $70M Series B

Autonomous Technologies Group: AI-powered wealth management advisor, raised $15M Preseed

Blackbird.AI: Online narrative tracking for businesses, raised $28M

BrightHeart: AI for prenatal heart defect detection, raised a $12.8M Series A

BriefCatch: AI legal-writing startup, raised a $6M Series A

CertHub: AI for medical device compliance automation, raised $7.2M

DayOne Data Centers: Hyperscale data center operator, raised over $2B Series C

Edison Scientific: Developer of "AI scientists" for research, raised $70M Seed

Interos.ai: Supply chain risk intelligence provider, raised $20M

Kargo: Industrial AI startup, raised a $42M Series B

Kraken Technologies: AI energy billing and ops software provider, raised $1B

Linker Vision: Physical AI software developer, raised $35M Series A

LMArena: Crowdsourced AI benchmarking startup, raised a $150M Series A

MiniMax: Chinese AI company, raised ~$619M in an IPO on HKEX

Moonshot AI: LLM startup, raised a $500M Series C

Neurable: Brain-computer interface AI developer, raised $35M Series A

Pluto: AI-powered private-markets lender, raised $8.6M Seed

Protege: Marketplace for proprietary AI training data, raised a $30M Series A extension

Resolve AI: "AI production engineer" platform, raised Series A at $1B valuation

Spangle AI: AI for personalized online retail experiences, raised a $15M Series A

Topos Bio: AI drug discovery startup, raised $10.5M Seed

Tucuvi: Voice AI for clinical care management, raised a $20M Series A

xAI: Foundational LLM Developer, raised a $20B Series E

Z.ai: Chinese LLM company, raised ~$558M in an IPO on HKEX