- Stepmark Weekly Newsletter

- Posts

- February 7th Newsletter

February 7th Newsletter

Before we unpack this week’s actions, click here for our deck highlighting the financials from selected public companies.

|

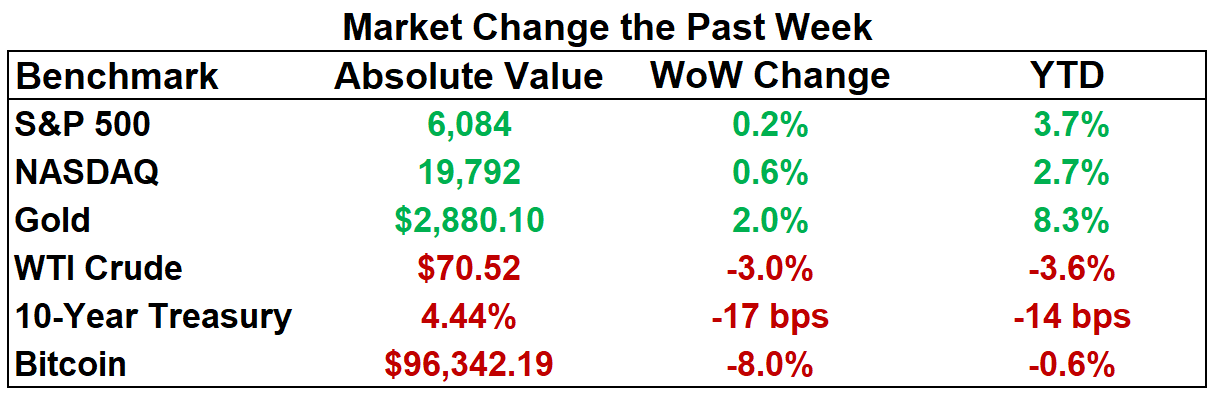

As of close on February 6, 2025

Market volatility continues this week as Trump paused 25% tariffs on Mexico and Canada after both made concessions to increase border security. He also imposed a 10% tariff on all Chinese imports, prompting swift retaliation from Beijing—including new tariffs and export restrictions. On Tuesday, U.S. job openings reportedly fell to 7.16 million from 8.15 million in November, while a more-than-expected 183,000 Americans were hired in January by the private sector. U.S. manufacturing expanded for the first time since 2022, driven by higher orders and production. In Tech, Google announced the ending of their DEI program, following a previous announcement by Meta. Additionally, Meta is considering reincorporating from Delaware to Texas, citing legal and regulatory conditions. Trump signed an executive order establishing a U.S. sovereign wealth fund, which could potentially acquire TikTok. On another note, the Beatles won a Grammy on Sunday for an AI-assisted version of 1973's “Now and Then”.

Monthly AI Financing Report: Starting in February, we will be sharing a monthly report of the top AI financing activity gathered from public and proprietary sources. See the latest report here.

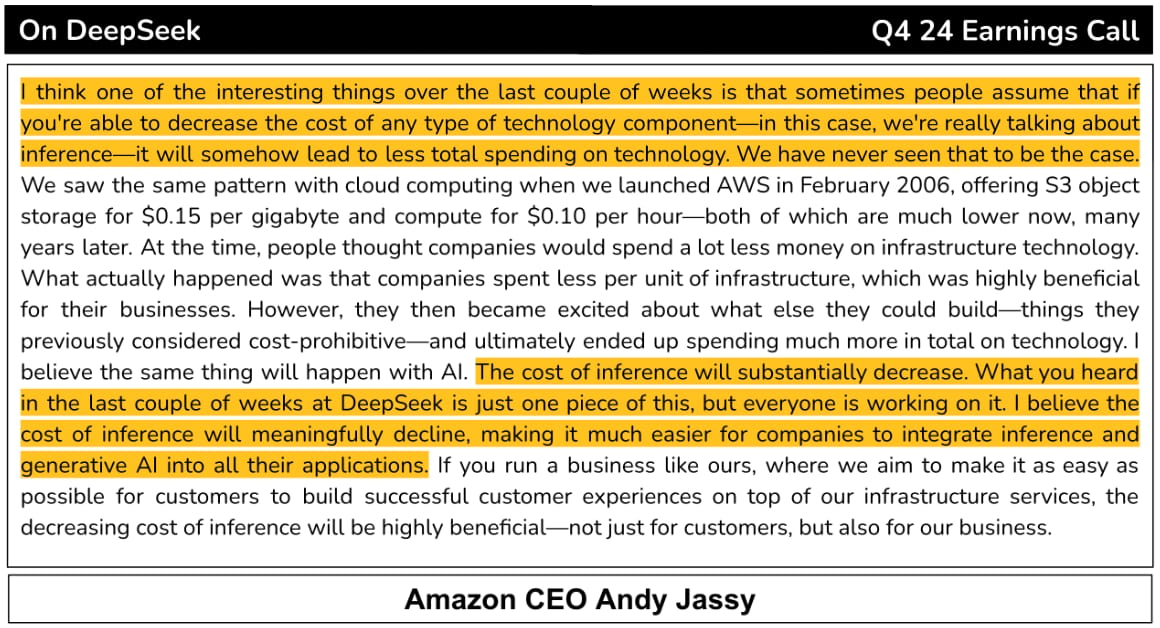

Notable quotes from Amazon's CEO on their earnings call: Despite DeepSeek's perceived threat to AI investments, Andy Jassy believes cheaper AI leads to more AI usage.

Top 5 AI Highlights

[1] 💬OpenAI has introduced a new “deep research” feature for ChatGPT Pro. Additionally, OpenAI released o3 mini, a small reasoning model, 11 days after competitor DeepSeek’s R1 model was launched. Meanwhile, a trademark filing reveals OpenAI’s interest in hardware ranging from wearables and AR/VR devices to humanoid robots—reflecting the company’s recent robotics hires and rumored custom chip development. The deep research tool accepts text, images, PDFs, and spreadsheets. Additionally, OpenAI plans to air its first ever Super Bowl commercial on Sunday. Read from The Verge, TC, and WSJ.

[2] 🕵️♂️Google’s release of DeepMind’s Gemini 2.0 marks a new era in agentic AI with advanced multimodal capabilities. The Gemini 2.0 Flash model is open to developers via the Gemini API in Google AI Studio, Vertex AI, and the Gemini app on desktop and mobile, featuring tools like native image generation, text-to-speech, and deep research. Early prototypes such as Project Astra and Project Mariner, refined with trusted user feedback and powered by custom Trillium TPUs with robust safety protocols, set a new benchmark for universal AI assistance. More from Google.

[3] 🔍Alphabet CEO Sundar Pichai announced plans to invest about $75 billion in capital expenditures in 2025, exceeding the $59.73 billion consensus estimate. Most of the spending will focus on technical infrastructure—especially servers, data centers, and networking—to support Google’s AI expansion. On its earnings call, the company said it expects $16 billion to $18 billion in first-quarter spending and plans to increase hiring in AI and Cloud. More from CNBC

[4] 📦Amazon plans to spend $100 billion on capital expenditures in 2025, up from $83 billion last year, mainly to expand AWS AI infrastructure with more data centers, networking, and custom chips. Q4 CapEx reached $26.3 billion, signaling a strong investment pace. CEO Andy Jassy sees AI as a "once-in-a-lifetime opportunity," despite rising investor skepticism. Amazon’s spending surpasses Microsoft ($80B), Alphabet ($75B), and Meta ($65B), as cost-efficient AI models like DeepSeek’s raise questions about the returns on massive AI investments. More on CNBC.

[5] 🤖Figure AI is leaving the collaboration with OpenAI to focus on in-house AI after a breakthrough in fully end-to-end AI for humanoid robots, enabling more scalable real-world robotics solutions. This move follows an industry trend of developing proprietary AI tightly integrated with specialized hardware at a faster pace. Meanwhile, OpenAI’s ongoing hardware and robotics ventures may have also influenced Figure AI’s decision to differentiate with an internal AI stack. Read more from X.

Founder’s Corner

Source: X

What We Read and Listened to This Week

Banks sell down $5.5 billion of the $13 billion of Musk's X debt to investors. (YF)

DOGE reportedly fed sensitive Education Department data—including personal and financial details—into an AI system to identify potential spending cuts. (WP)

Ford forecasts up to $5.5 billion in EV losses in 2025 amid cost-cutting challenges and tariff uncertainties, causing shares to drop nearly 5%. (NYP)

Ford CEO supports consumer choice among ICE, hybrid, and EV vehicles, but expects EVs to eventually dominate. (YouTube)

Nissan rejected Honda's merger that would subordinate Nissan to Honda, jeopardizing the planned equal partnership and prompting more negotiations. (WSJ)

MicroStrategy rebranded as Strategy, reported a Q4 loss driven by a $1B bitcoin impairment after ending aggressive buying to only target a 15% annual yield. (SA)

Salesforce is cutting over 1,000 positions even as it embarks on a hiring spree for sales roles dedicated to its new AI products. (Bloomberg)

Special Earnings Section

Alphabet reported $96.4 billion in revenue, +11.8% YoY, missing estimates by -0.2%. (CNBC)

Amazon reported Q4 revenue of $187.23 Billion, +10.5% YoY, yet shares slid 4% due to poor Q1 guidance. (CNBC)

Arm reported Q4 revenue of $983 million, +6% YoY, royalty revenue +23% YoY, yet shares fell 6% Wednesday after doubts were cast on its role in the Stargate Project. (YF)

Disney reported revenue of $24.7 billion, +4.9% YoY, driven by streaming gains and a box-office hit from "Moana 2". (WSJ)

Palantir reported revenue of $558 million, +52% YoY, closing 219 deals, leading shares to jump 27%.(CNBC)

Qualcomm reported revenue of $11.67 billion, +17% YoY, yet stock fell 4.8% after announcing the expiration of its agreement with Huawei. (YF)

Spotify posted its first full year of profitability adding 11 million new premium subscribers, causing stocks to rise 12% post earnings. (Barrons)

Uber reported revenue of $11.9 billion, +19% YoY, yet its gross bookings only increased 18% YoY, missing predictions and causing shares to slip 9%. (YF)

AI M&A and Fundraising news (Jan 31 — Feb 6)

Aircon: AI-powered cargo consolidation for aircraft capacity, raised a $5.08M Seed.

Alma: Nutrition tracker platform leveraging AI, raised $2.9M.

Bigabid: Proprietary ML for optimized mobile advertising, raised a $25M Series A.

Cinamon: South Korean AI-animated video generation platform, raised a $8.5M Series B.

Desteia: Supply chain co-pilot for disruption mitigation and savings, raised a $8M Seed.

Franzy: AI-powered platform streamlining the process of buying a business, raised a $1M Pre-Seed.

GetWhys: An AI-powered platform offering B2B customer insights, raised a $2.8M Seed.

Hero: All-in-one productivity app with an AI assistant, raised a $4M Seed.

INFI USA: AI self-service software platform, raised a $12M Series A.

Ivo: AI-powered platform for legal contract review, raised a $16M Series A.

Jump: Provider of AI-powered meeting automation tools for financial advisors, raised a $20M Series A.

Krutrim: Indian AI research startup, raised $230M.

LogicStar: AI agents for software maintenance, raised a $3M Pre-Seed.

Lorikeet: AI customer support for fintech and healthtechs, raised $9M.

Neuralk-AI: A startup developing AI models specifically designed for spreadsheet data, raised $4M.

MagicSchool AI: An AI platform addressing teacher burnout by streamlining lesson planning, assessments, and IEP writing, raised a$45M Series B.

Olas: AI agent platform, raised $13.8M.

Perspective AI: Customer conversations startup, raised a $4M Seed.

Presentations.ai: Indian AI startup building 'ChatGPT for presentations’, raised a $3M Seed.

Prior Labs: AI models for analyzing structured data, raised a $9.4M pre-seed.

Protex AI: AI-powered CCTV enhancer, raised $36M in Series B.

Qount: Developer of AI-powered practice management software solutions for public accounting firms, raised $17M.

Semeris: Finance-focused legal AI company, raised $4.3M.

Semgrep: AI-assisted triage and autofix, raised a $100M Series D.

StackAdapt: AI programmatic advertising platform, raised $235M.

Tana: AI-native workspace platform, raised a $14M Series A.

TeamSec: AI-powered securitization platform for structured finance, raised $7.6M.

Trace.Space: AI software for managing and tracking product requirements in engineering, raised a $4M Seed.

Unwrap: AI-powered customer intelligence platform, raised a $12M Series A.